Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market remains stable. Tight supply and high quotations at the tungsten mine end play a major role in stabilizing the market. However, it still takes time for downstream to accept high-priced raw materials. The market trading atmosphere is relatively light, and purchases are mainly on a use-as-you-go basis.

Under the expectation of increased strategic value, the confidence in the market's periodic rebound has increased. However, the supply and demand game situation is not yet clear, and the uncertainty of the external economic situation still exists. The overall market sentiment is cautious. In the short term, industry players are watching the new round of institutional forecast prices and tungsten enterprise long-term purchase prices.

The price of 65% black tungsten concentrate is RMB 173,000/ton. Due to the restrictions of resource grade and mining indicators, as well as the reluctance of holders to sell, the market supply increment space is limited, the price at the mine end shows strong resilience, and the market is strong.

The price of ammonium paratungstate (APT) is RMB 252,000/ton. The raw material end remains strong, downstream users follow up on demand, there are few new orders in the market, and the market is mainly driven by the cost end to maintain stability.

The price of tungsten powder is RMB 378/kg, and the price of tungsten carbide powder is RMB 370/kg. Powder metallurgy and its downstream end customers give priority to digesting existing inventory, and new purchasing demand is weak, resulting in low market trading activity and strong wait-and-see sentiment among participants.

The price of 70 ferrotungsten is RMB 258,000/ton, with stable support on the cost side and continued on-demand purchasing strategy on the consumer side. There is no obvious fluctuation in cost or supply and demand signals in the market, and there is limited room for price adjustment in the short term.

The price of tungsten scrap is temporarily stable, and the market is affected by the supply and demand game situation. At present, both buyers and sellers are cautious, and the price fluctuation space is limited. The market maintains a consolidation pattern.

In terms of news, domestic leading photovoltaic glass companies plan to start a 30% collective production cut in July, reflecting the strategic transformation taken by companies to cope with the imbalance between supply and demand during the deep adjustment period of the photovoltaic industry chain. In the short term, as a key auxiliary material for photovoltaic components, the shrinking production capacity of photovoltaic glass may have a chain effect on the application of tungsten products in the photovoltaic industry. For example, the consumption of tungsten wire in the diamond wire cutting link may decrease due to the reduction in silicon wafer output. In the long run, the reduction in photovoltaic glass production will help curb the extensive expansion of the industry and reshape the value system of the photovoltaic industry chain. It may also promote the accelerated replacement of traditional carbon steel wire with tungsten wire, and help the photovoltaic industry develop in an efficient and sustainable direction.

Prices of Tungsten Products on July 2, 2025

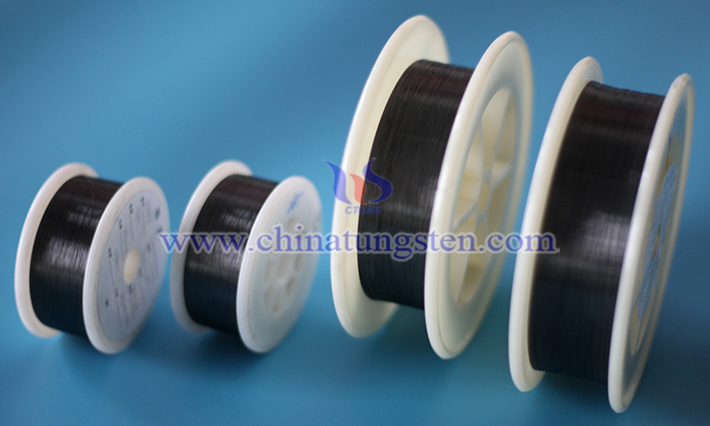

Picture of Photovoltaic Tungsten Wire